Online Banking Features

Woodforest Online Banking and Mobile Banking App* provide convenient and secure access to your Woodforest accounts from home, work, or wherever an internet connection is available.*

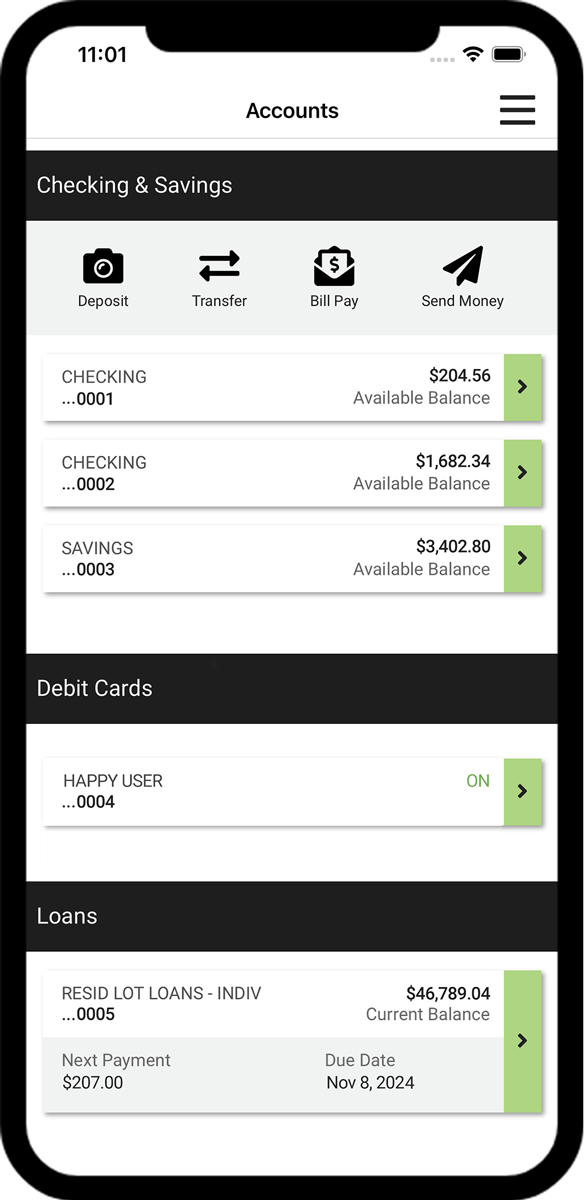

View current and past statements, check current transactions, view check images, and more.

Move money to/from your eligible Woodforest accounts. You can create one-time transfers, recurring transfers, and future transfers.

Receive alerts by email, SMS, or push notification. Set your own criteria for balance alerts, transaction alerts, debit card alerts, and more.

Receive your statements electronically by enrolling in eStatements.

Personalize your account names. Re-order checks. Order a Woodforest Debit Card. Manage eStatements. Plus more!

Download your account transactions in a few easy clicks.

Provide your email at account opening to automatically receive a daily statement of transaction activity, account balances, and more.

Security features to help protect your online sessions such as Second Factor Authentication and Limited Access Passwords.

Learn More

| How to Set Up a Mobile Authenticator in Online Banking | |

| How to Enable Text Message Authentication in Online Banking |

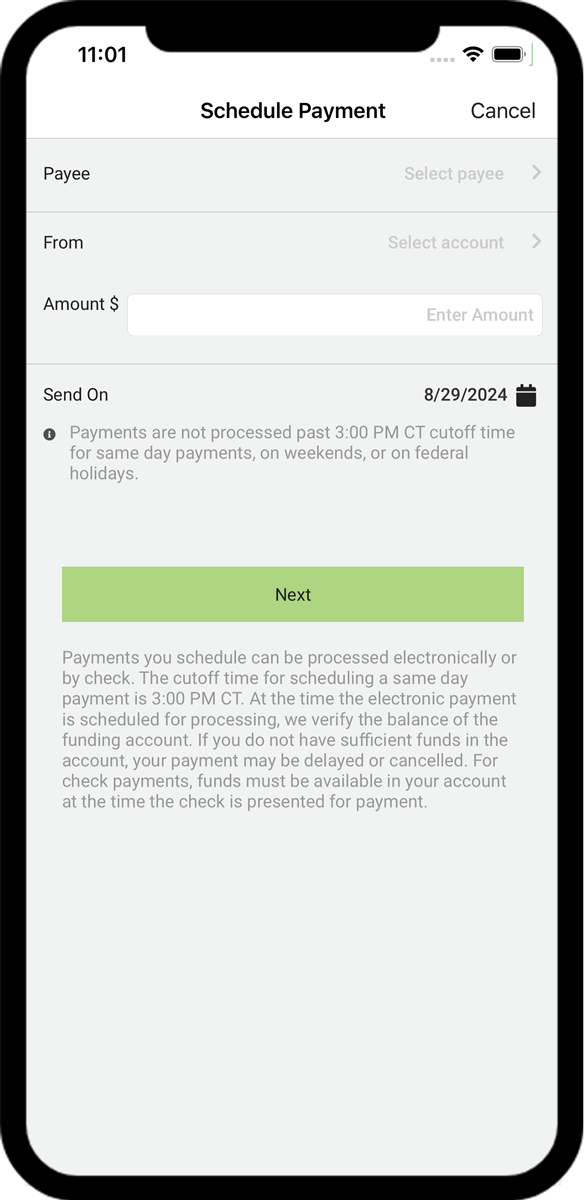

Set up e-bills for recognized payees, payment reminders, and automatic recurring payments.

| How to Add a Payee in Online Banking | |

| How to Pay a Bill in Online Banking |

Account(s) opened at a branch today are accessible online by tomorrow. Account(s) opened online are accessible for Online Banking immediately.

Please note, if you are a Small Business customer and would like to enroll your business in Online Banking, please contact us toll-free at 1-877-968-7962 for assistance.

Banking Privacy and Security

Public WiFi can leave you exposed.

Many public WiFi hot spots lack any kind of security making it easier for scammers to listen in on your activity.

Passwords are your first line of defense.

Using a complex and random password is the easiest way to protect your information, which makes it harder for thieves to guess.

Be aware of Phishing Techniques.

Phishing is when scammers call or send an email pretending to be a reputable company to trick you into giving them personal information.

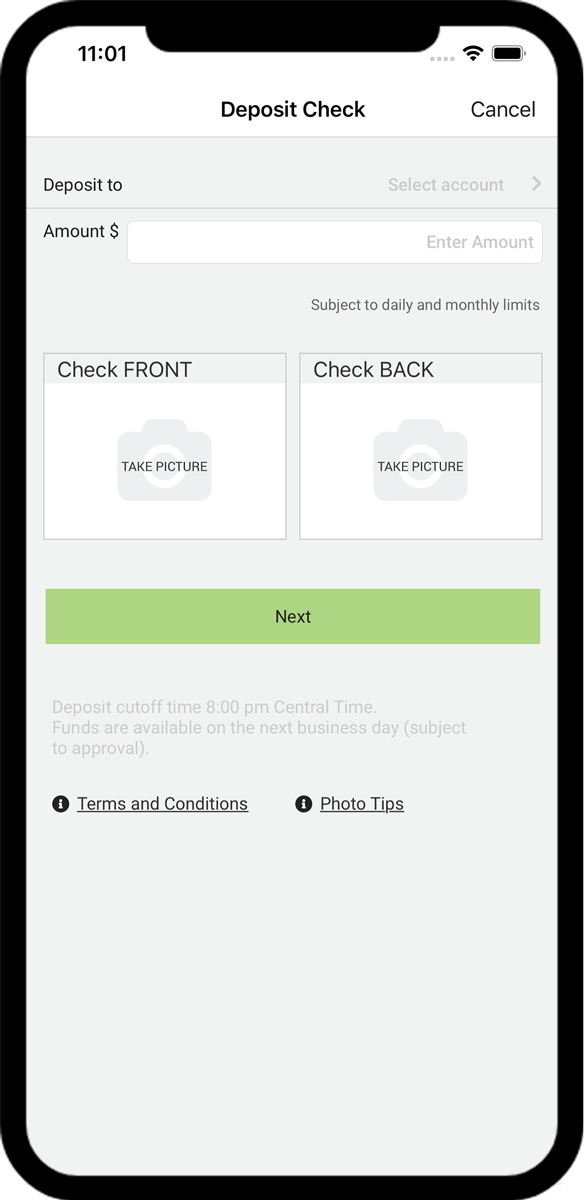

Making deposits from your phone is a snap with our Mobile Banking App.*

Make a transfer between eligible accounts and schedule payments or view payment history.

Send and Receive Money Transfers directly to/from eligible Woodforest accounts.

| App at a Glance |

Use the Mobile Banking App* to send money to anyone with a U.S. bank account -- no matter where they bank.(1)

Go Paperless with eStatements!

Enjoy the convenience and security of receiving your bank statement online with eStatements, one of the many benefits of Woodforest Online Services! Enrolling in Online Services and signing up for eStatements is quick and easy. When your eStatement is available, you will receive an email notification sent to the email address you designate. Simply log in to Online Services to view or download your eStatement(s) from the account(s) you select.

- Eliminate cumbersome paper statements received in the mail, which means you no longer need to file or shred paper statements.

- Be confident that your electronic statements are safe and secure, increasing protection against identity theft and eliminating them from being taken from your mailbox or delivered to the wrong address.

- Have the convenience of viewing your statements days before you would receive them in the mail. Plus you can view them from your computer or a mobile device anytime, anywhere you have internet access.

- Save valuable resources by reducing the amount of paper required to produce paper statements.

To enroll, log into Woodforest Online Services, go to the Service Center, and select Manage eStatements.

Frequently Asked Questions

Additional Personal Banking Benefits

Mobile Deposit

Mobile Deposit is a secure and easy way to deposit a check from virtually anywhere, anytime!*

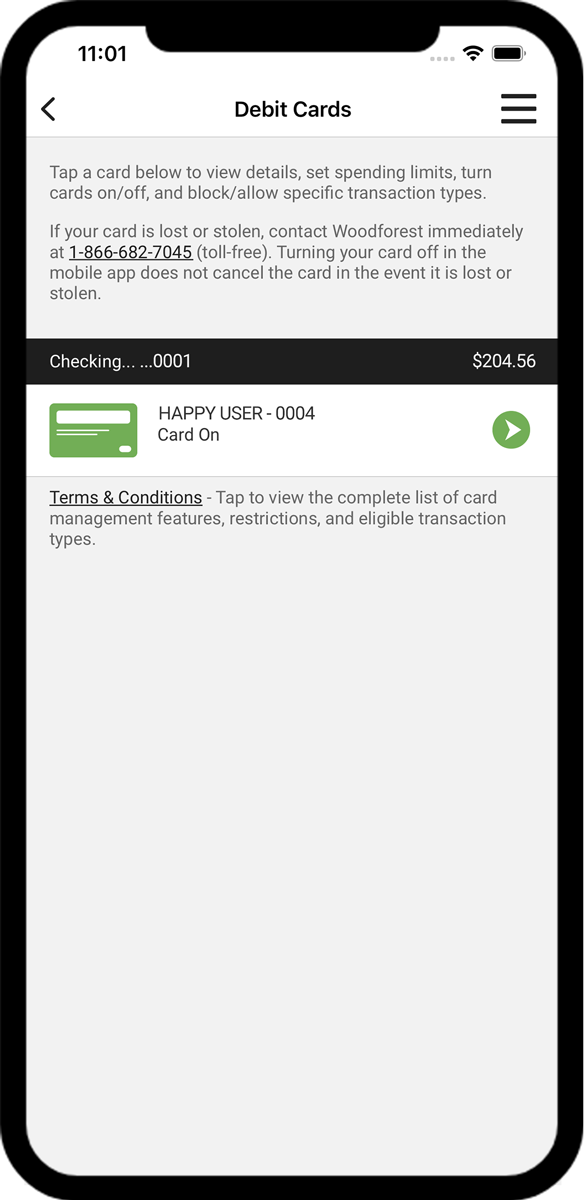

Debit Card Management

Debit Card Management helps you control when, where, and how your Woodforest Debit Card is being used.*

IDnotify

Identity theft protection bundle offer from IDnotify® for Woodforest National Bank® customers.

*Data rates may apply. See carrier for details. The mobile.woodforest.com website is available on mobile phones with a full internet browser. Your phone will display the website in either a rich or text version depending on the operating system and version currently installed on your device. The "Log In" option will appear on the main menu of supported devices capable of logging into online banking. If you have any questions about our mobile banking website, iPhone®, or AndroidTM applications, please contact us at 1-877-968-7962, email us at mobilesupport@woodforest.com, or visit your local branch. Additional limitations, restrictions and fees may apply for these services. You may speak to one of our Retail Bankers for more details.

(1) User and Recipient must reside within the U.S. Additional limitations and restrictions may apply for this feature. Please see a Retail Banker for complete details.